Protocol Overview: Strata

Learn everything about Strata

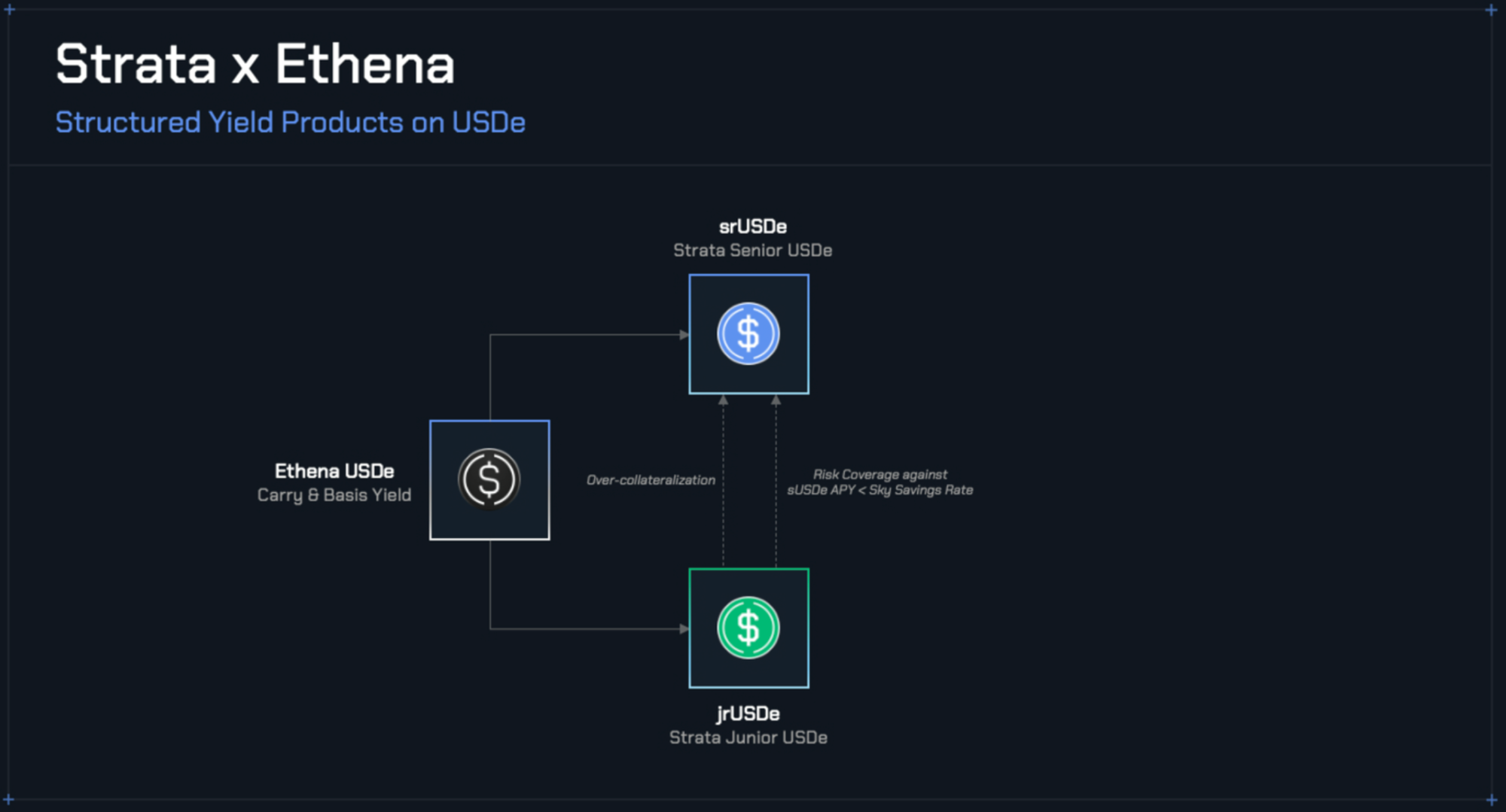

Strata is a perpetual risk tranching protocol. It builds structured yield products on USDe, Ethena’s synthetic, delta-neutral stablecoin, to give investors options depending on their risk tolerance.

Make sure to check the Ethena Overview, so you fully understand what Strata is built on.

🌐 Strata Protocol Overview

Strata is a structured yield protocol built on top of Ethena’s USDe and sUSDe. It introduces risk-tranching, allowing users to select between safer, more predictable returns or riskier, higher potential yields. By splitting sUSDe yield streams into “senior” and “junior” tranches, Strata creates tailored financial products that expand Ethena’s ecosystem.

🧠 Core Components

1. srUSDe: Senior Tranche

- Designed for principal protection and stable yield.

- Pegged to the Sky Savings Rate (SSR), which provides a yield floor.

- Receives priority allocation of sUSDe rewards before junior tranche distribution.

- Best suited for risk-averse investors seeking predictable income.

The Sky Savings Rate is variable, determined not by market factors but by Sky ecosystem governance through a process of decentralised onchain voting.

2. jrUSDe: Junior Tranche

- Designed for risk-tolerant investors seeking higher potential APY.

- Holds residual exposure to sUSDe yield fluctuations.

- Absorbs downside when yields are weak, but benefits disproportionately when yields are strong.

=> jrUSDe outperforms sUSDe APY in high-yield environments but may underperform when sUSDe APY drops below the benchmark rate.

3. pUSDe: Pre-Deposit Receipt Token (Season 0)

- Temporary token issued 1:1 for USDe/eUSDe deposits during the early incentive program.

- Fully redeemable and composable across DeFi.

- Earns Strata Points and potential partner rewards.

Around mid October 2025 will Strata transition from pUSDe to srUSDe and jrUSDe.

⚙️ Protocol Mechanics

- Underlying Yield Source: sUSDe rewards, generated by Ethena’s delta-neutral hedging, funding rate spreads, and staking returns.

- Yield Distribution: Split dynamically between senior and junior tranches depending on capital allocation and current APY.

- Cadence: Rewards accrue and redistribute roughly every 8 hours, aligned with sUSDe yield cycles.

- ERC-20 Composability: srUSDe and jrUSDe are permissionless, composable tokens usable across other DeFi protocols.

⚠️ Risk Considerations

- Yield Variability: Junior tranche absorbs volatility and may underperform if yields fall.

- Dependence on Ethena: Strata’s performance relies on Ethena’s hedging strategies and reward generation.

- Liquidity & Market Risk: Volatility can impact redemption values and secondary market liquidity.

- Smart Contract & Custody Risk: As with all DeFi protocols, risks exist from technical bugs or partner dependencies.

🪂 Airdrops & Points

To bootstrap adoption and reward early contributors, Strata launched a Points Program. During the initial rollout (Season 0), users who deposit USDe or eUSDe receive pUSDe, a redeemable receipt token that accrues Strata Points. These points track participation across the ecosystem: deposits, integrations, and other partner activities. They are expected to play a role in future governance, reward distributions, or token launches. By making pUSDe composable across DeFi, Strata ensures participants can still deploy their capital while earning points, effectively combining early-user incentives with ongoing capital efficiency.

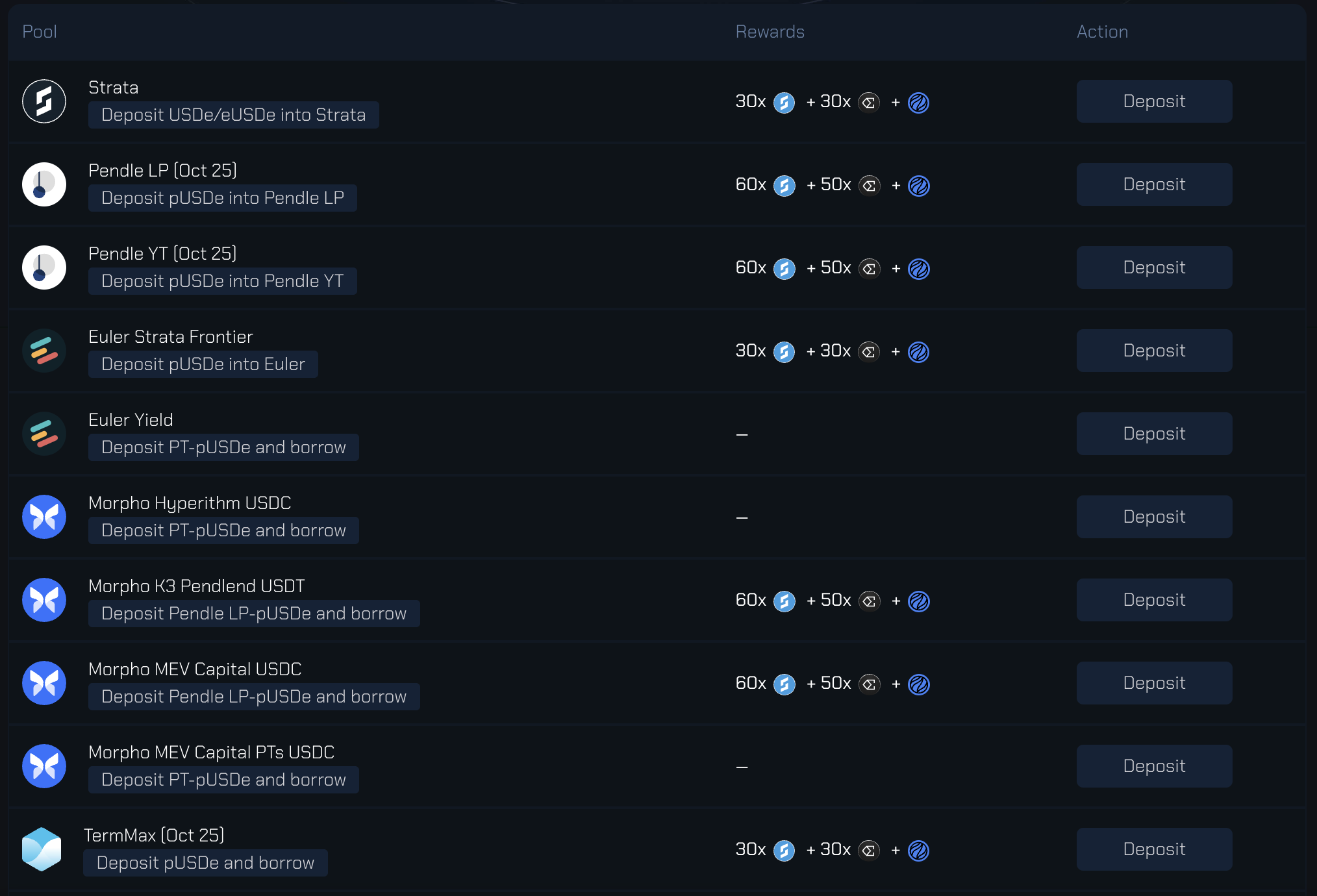

You can check which protocols give points and what the multipliers are here!

The current highest multiplier is 60x on Strata points. One other advantage of Strata is that you also receive Ethena points (Shards), and Ethereal points (although the multiplier is only 1x).

For example, the Pendle pUSDe LP gives 60x Strata points and 50x Shards, as opposed to Ethena's Pendle USDe LP, which gives 60x Shards (and no Strata points). You're essentially "trading" a 10x Shards boost for a 60x Strata boost.

Since Strata didn't TGE yet, you can speculate on Strata's FDV to determine whether losing a 10x Shards boost is worth a 60x Strata points boost.

If you want to deposit, feel free to use my referral link, which will give you a 10% boost! https://deposit.strata.money/?ref=3AG1GfjD

Comments ()