Protocol Overview: Ethena

Learn everything about Ethena

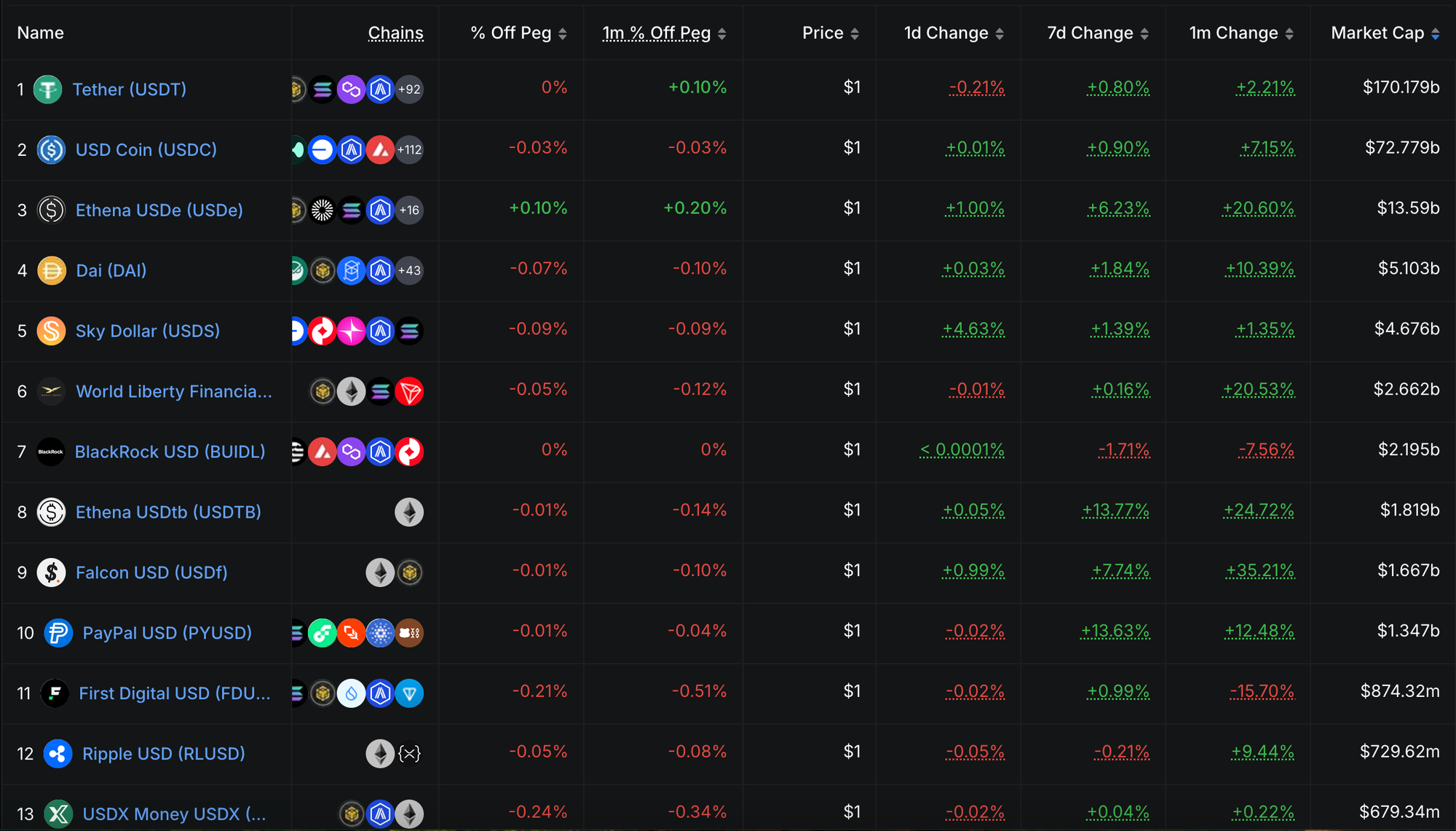

Ethena is the third largest stablecoin project, according to Defillama. The biggest one is Tether (USDT), followed by Circle (USDC).

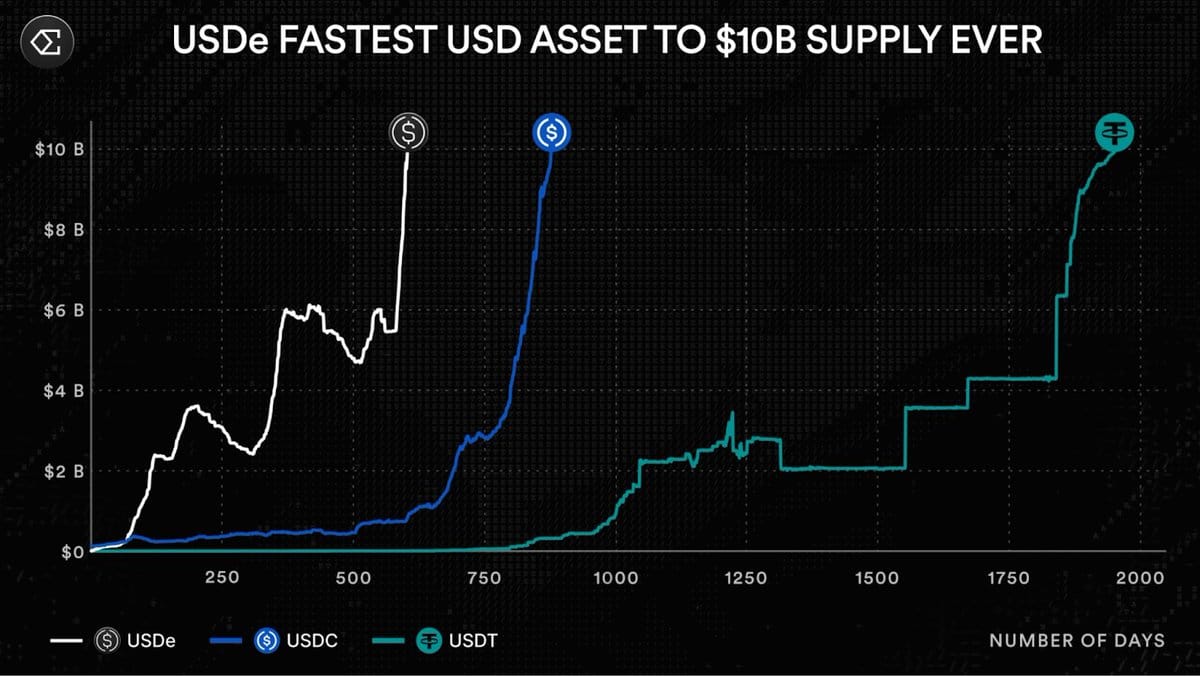

USDe is the fastest USD asset to reach $10Bn supply!

🌐 Ethena Protocol Overview

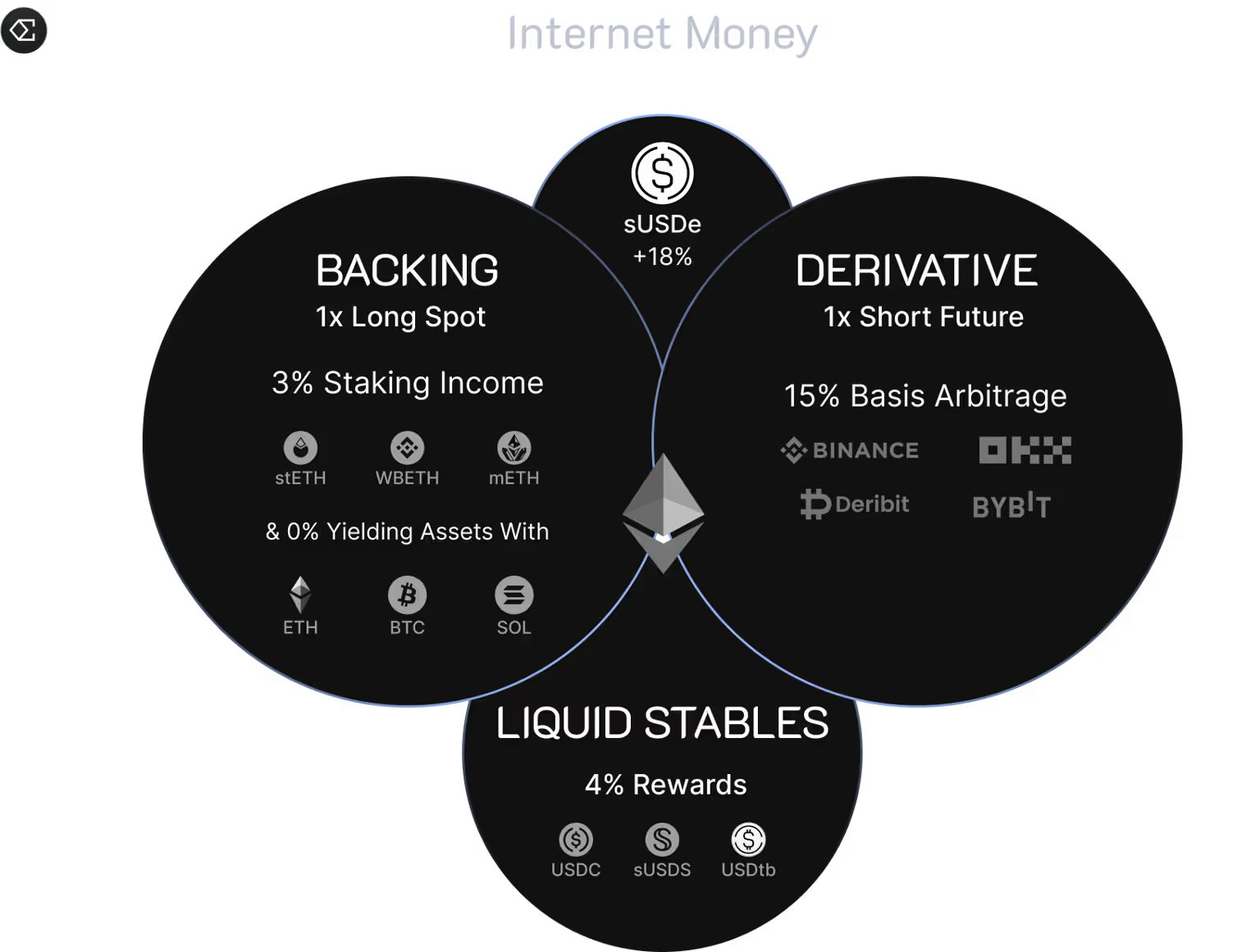

Ethena is a decentralized finance (DeFi) protocol built on Ethereum, introducing a synthetic dollar stablecoin, USDe, and a yield-generating asset, sUSDe. Unlike traditional fiat-backed stablecoins, USDe leverages crypto-native strategies to maintain its peg and offer scalability, censorship resistance, and yield opportunities.

🧠 Core Components

1. USDe: Synthetic Dollar

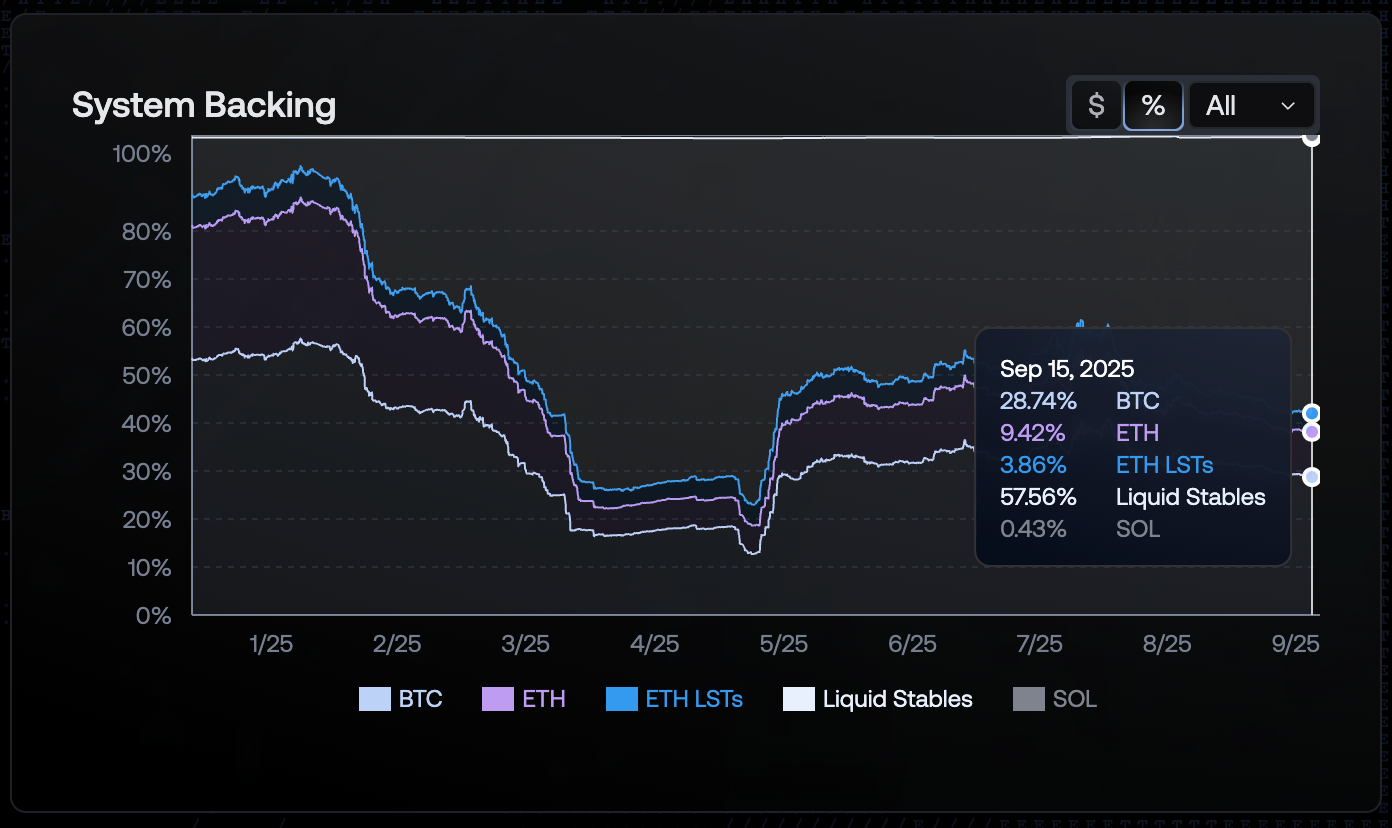

- Delta Neutral Stability: USDe is backed 1:1 by crypto assets like ETH, BTC, and SOL, with corresponding short futures positions to hedge against price fluctuations. Liquid stables such as USDC and USDT are also utilized to enhance stability and efficiency. USDC on Coinbase closely tracks the US Treasury yield.

- Minting & Redemption: Users mint USDe by depositing approved assets (after KYC/AML checks), and the protocol simultaneously opens short positions in derivatives markets to maintain a neutral exposure. Redeeming USDe involves reversing this process. Users can also freely buy/sell USDe on many liquidity pools & CEXes.

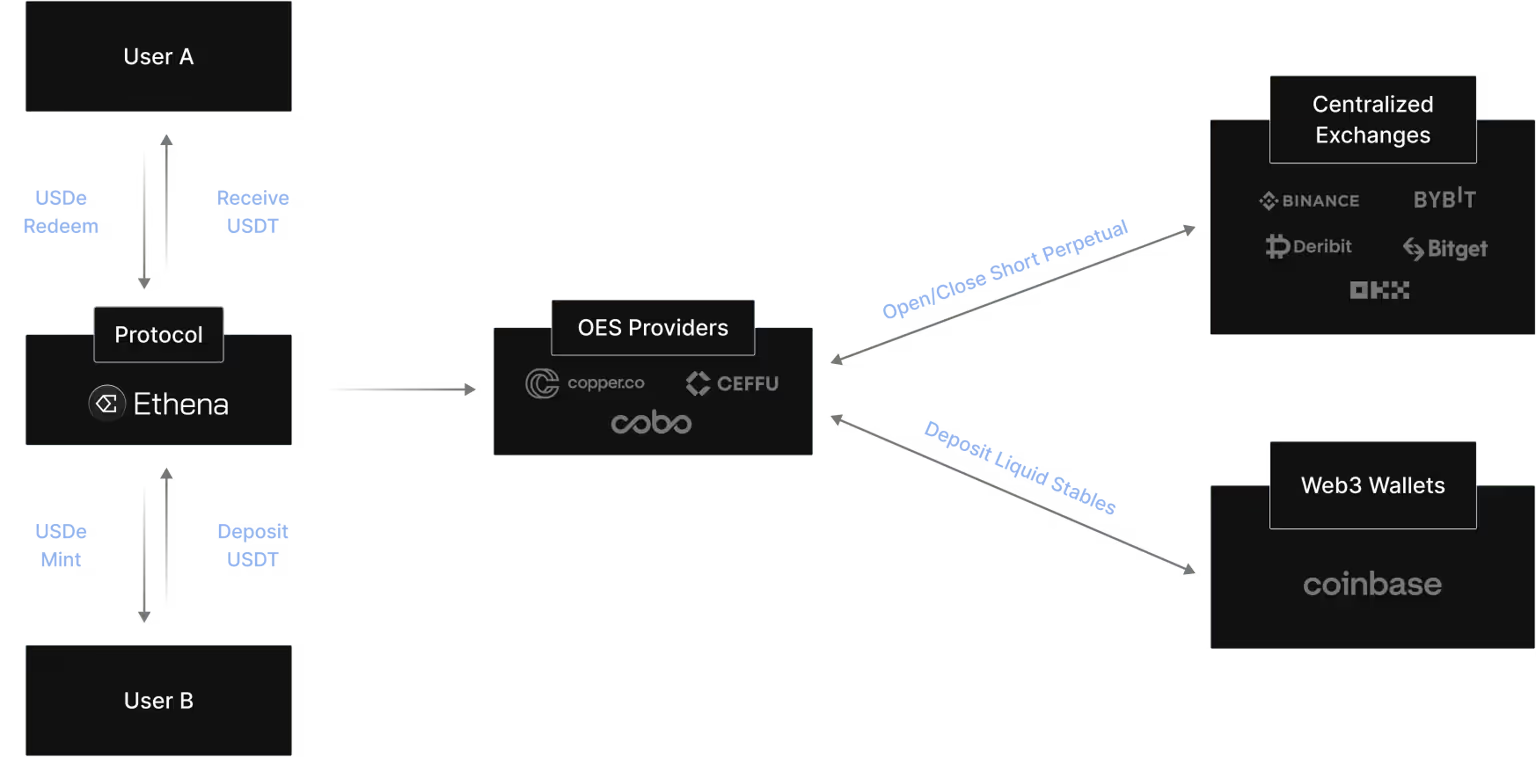

USDe mint/redeem process:

Here's the example given on the Ethena website:

- A whitelisted user provides ~$100 of USDT and receives ~100 newly-minted USDe atomically in return less the gas & execution costs to execute the hedge.

- Slippage & execution fees are included in the price when minting & redeeming. Ethena earns no profit from the minting or redeeming of USDe.

- The protocol opens a corresponding short perpetual position for the approximate same notional dollar value on a derivatives exchange.

- The backing assets are transferred directly to an "Off Exchange Settlement" solution. Backing assets remain onchain and custodied by off exchange service providers to minimize counterparty risk.

- Ethena delegates, but never transfers custody of, backing assets to derivatives exchanges to margin the short perpetual hedging positions.

The System backing can be found here.

2. sUSDe: Yield Bearing Asset

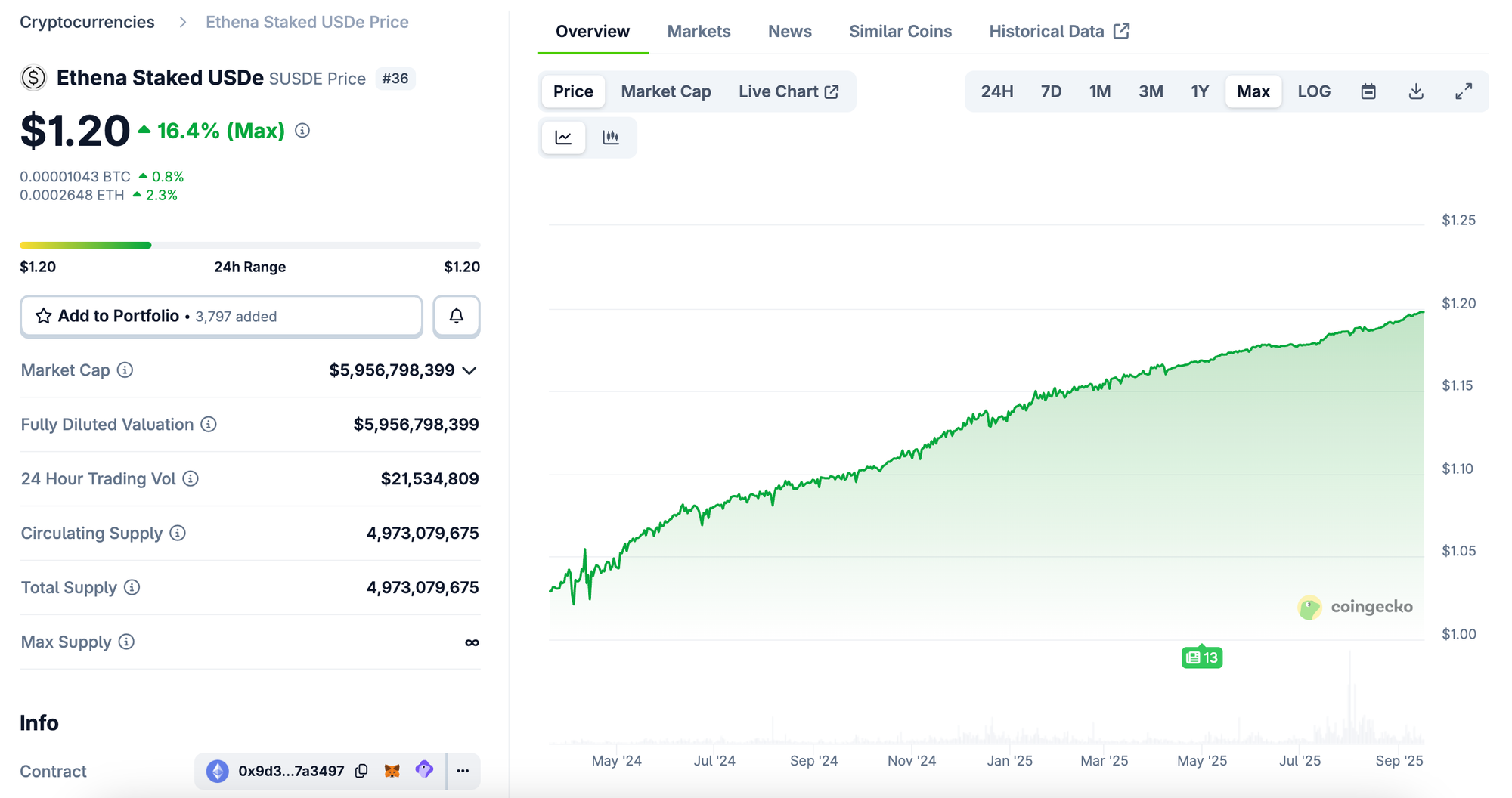

- Internet Bond: sUSDe is a tokenized representation of staked USDe, earning rewards from the protocol's yield-generating activities. Its price should always increase, as it accumulates the rewards.

- Reward Sources: Earnings are derived from:

- Staking Ethereum (ETH) rewards.

- Funding and basis spread from delta hedging positions.

- Fixed rewards on liquid stablecoins.

Here you can see how sUSDe's price slowly and steadily goes up.

3. ENA: Governance Token

- Protocol Governance: ENA token holders participate in governance decisions, including electing members to the Risk Committee and other future committees. sENA holders will also be able to vote directly on ENA tokenomics proposals and any proposals concerning ENA specifically

- Staking ENA: Users can stake ENA to earn rewards and participate in the protocol's decision-making processes.

- Shards Boost: Users with sENA get a 20-100% boost, based on your total value of sENA and your USDe positions

- Ethena Network airdrop: This initiative aims to directly support new protocols innovating with Ethena sUSDe enabled applications while aligning ENA with the success of these new protocols. sENA holders might receive an airdrop from the Network members.

The ENA fee switch might be activated once it passes the governance process.

💰 Revenue Model

Ethena's protocol revenue is generated from three sources:

- Staked Asset Rewards: Income from staking Ethereum.

- Derivatives Trading: Earnings from funding and basis spreads in delta hedging positions.

- Liquid Stablecoin Rewards: Fixed returns from holding liquid stablecoins like USDC and USDT.

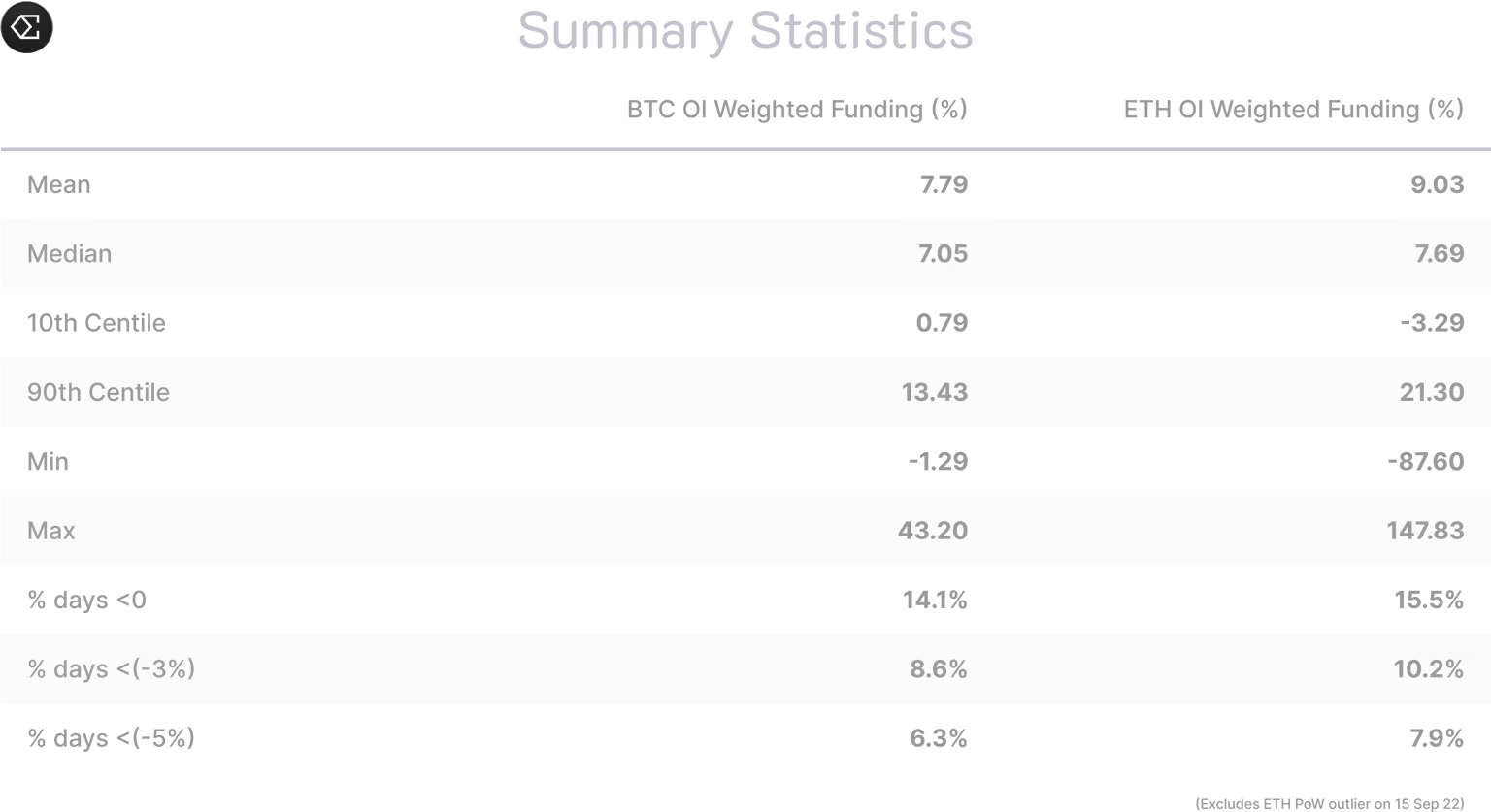

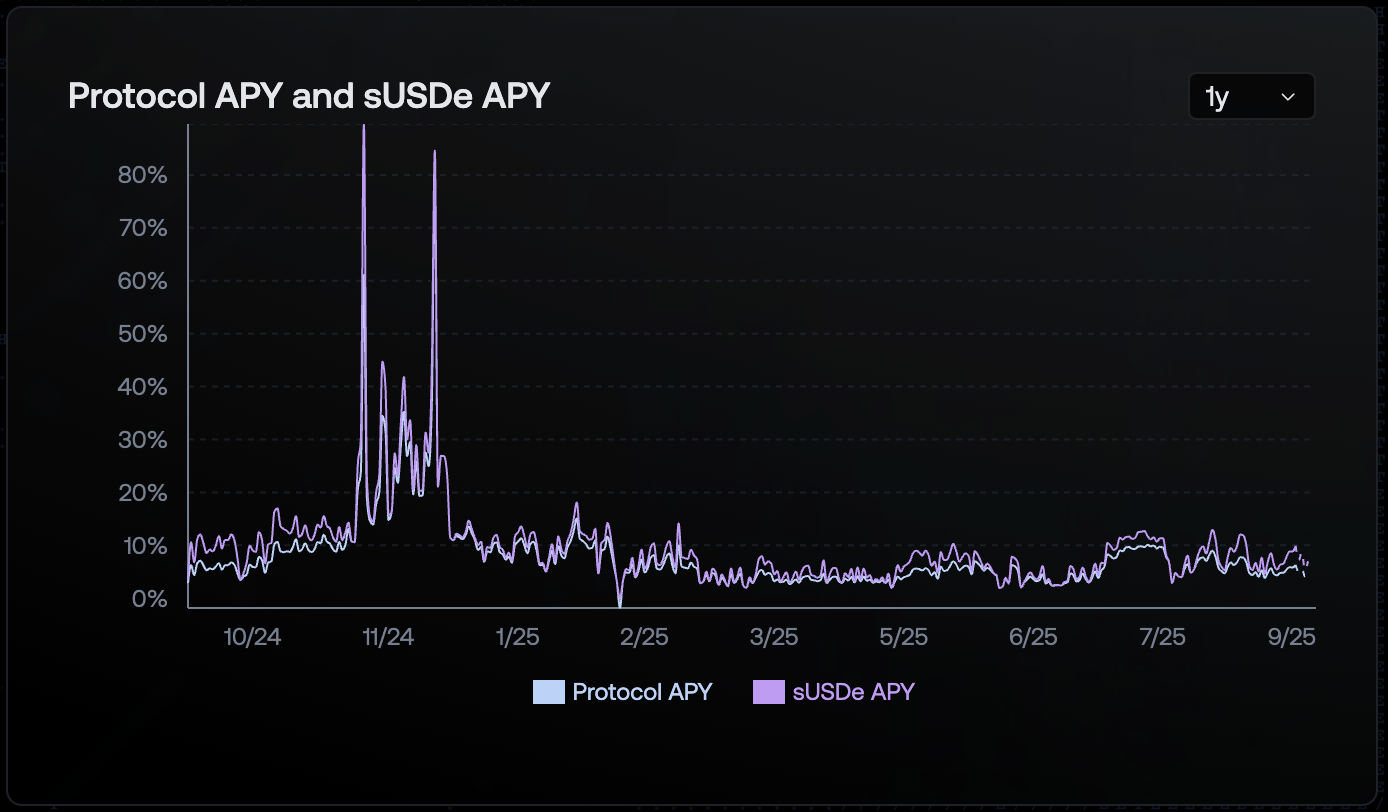

Revenues mostly come from funding and basis spreads, and liquid stablecoins rewards. For the funding and basis spreads revenue section, they largely depend on current market conditions. You can find more data here. Secondly, liquid stables tend to earn the US treasury rate. They act as a "cushion" if the funding and basis spreads strategy becomes less profitable, or unprofitable.

You can check the current and historical sUSDe APY here.

⚠️ Risk Considerations

While Ethena offers innovative solutions, users should be aware of potential risks:

- Funding Risk: Variability in funding rates can impact earnings from derivatives positions. In periods of low or negative funding, this risk can be mitigated by allocating more backing to liquid stables.

- Liquidation Risk: Market volatility may lead to the liquidation of collateralized positions. This event is unlikely, considering Ethena uses very minimal leverage. ETH LSTs currently represent less than 4% of the total backing.

- Custodial Risk: Dependence on third-party custodians introduces counterparty risk.

- Exchange Failure Risk: Technical issues or failures in derivatives exchanges can affect the protocol's operations.

- Backing Assets Risk: Devaluation or illiquidity of backing assets can impact the stability of USDe. Again, this risk is limited as LSTs represent less than 4% of the total backing.

- Stablecoin-Related Risks: Regulatory changes and market dynamics can influence the adoption and stability of stablecoins.

- Margin Collateral Risks: Ethena uses perpetual futures that are denominated in USDT. Denominating in Tether means that the margin and PNL calculations are quoted in Tether, and by extension, results in Ethena being positionally long USDT. This exposes Ethena to a potential USDT idiosyncratic risk.

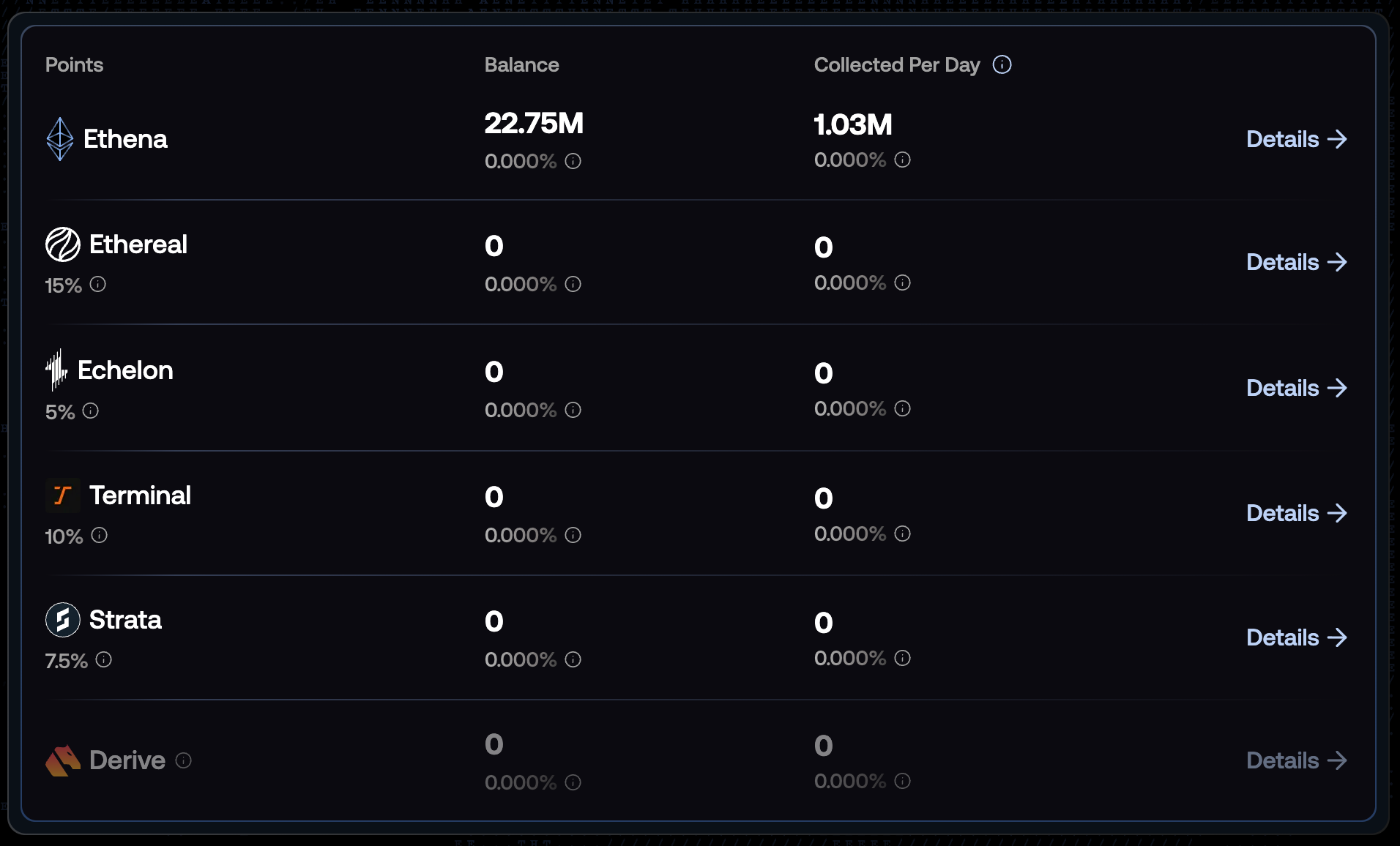

🪂 Airdrops & Points

sUSDe's yields are not the only reason why Ethena's growth has been impressive.

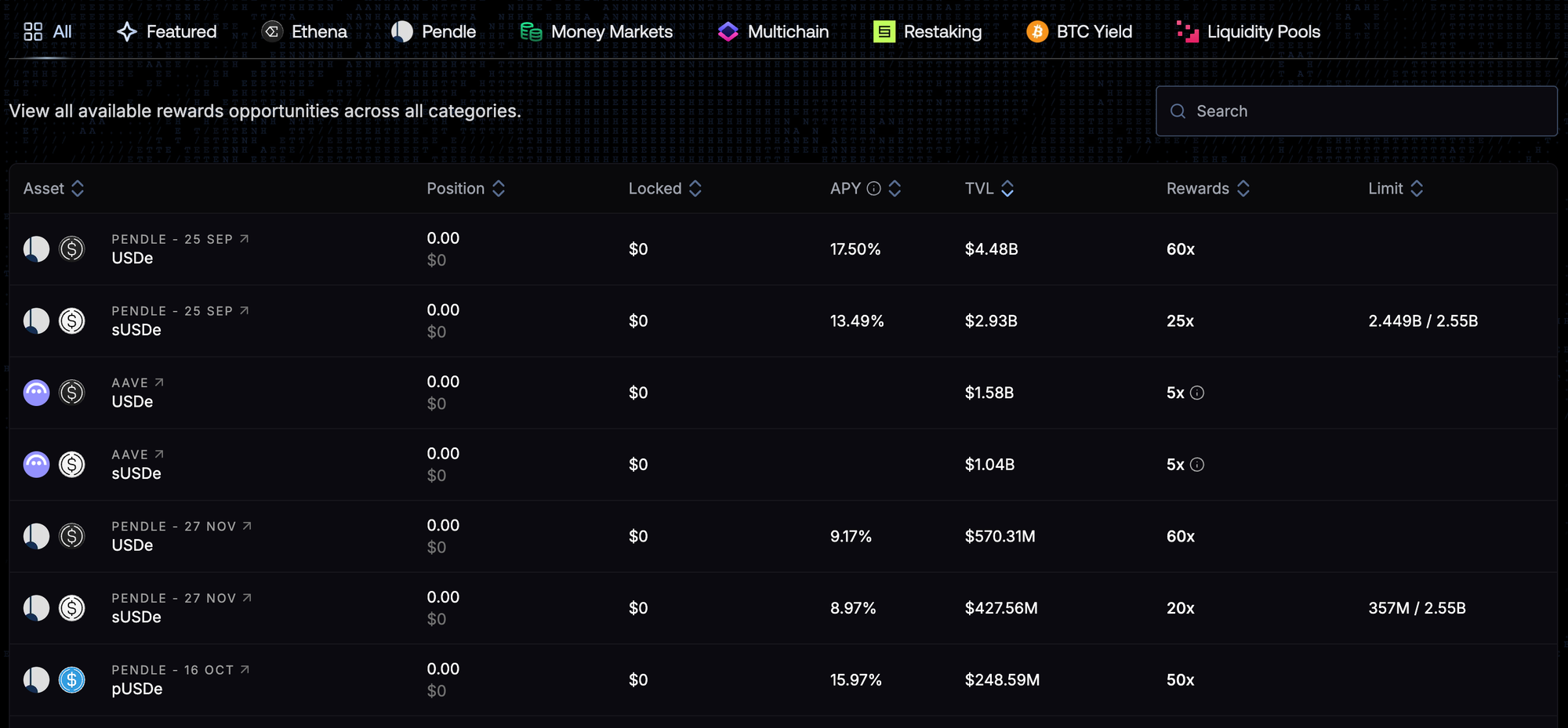

Indeed, points/shards have also been fueling Ethena's growth. As we can see in the image below, the TVL on Pendle and Aave exceeds $10Bn.

When users deposit or interact with USDe related assets, they can earn points. The amount of points earned depends on what assets they hold and where they are deposited.

For example, holding sUSDe in your wallet does not give points, but if you deposit them on Aave, you will earn 5x shards

The biggest multiplier (without leverage) is 60x.

All these multipliers allow users to speculate on the price of shards and use Pendle to leverage points with YTs or get fixed yields with PTs. Additionally, users can also earn of both by providing liquidity.

For season 4, the airdrop represents 3.5% of the total amount of ENA tokens. The dashboard also indicates how many shards are in circulation. This allows you to estimate how profitable each strategy is.

Pendle Intern often shares various Pendle strategies, go have a look.

Feel free to use my referral link if you plan to use Ethena: click here!

You can estimate your season 4 ENA airdrop here:

Comments ()