DeFi 101: What is a money market?

Understand what a money market is and how they work

Decentralized Finance has unlocked new ways for people to use their money beyond simply holding, trading, or staking crypto. One of the most important innovations in this space are money markets (MM), also called lending platforms. These platforms allow people to lend out their crypto to earn interest or borrow crypto by using their assets as collateral, all without relying on banks or traditional intermediaries. Everything can be done instantly. As soon as you deposit collateral, you can borrow crypto.

In this guide, we’ll break down what money markets are, how they work, and why they matter.

What Is a Money Market in DeFi?

In traditional finance, a money market is where institutions and individuals borrow and lend short-term funds, like treasury bills or commercial paper. DeFi takes this idea and brings it on-chain, using smart contracts instead of banks.

On a DeFi lending platform, you can:

- Lend: Deposit your crypto into a pool and earn interest.

- Borrow: Take out a loan by locking up your crypto as collateral.

Everything runs automatically through code: no bank managers, no paperwork, just blockchain transactions.

How DeFi Lending Platforms Work

1. Liquidity Pools

Instead of matching individual lenders and borrowers, DeFi platforms use liquidity pools. These are big pools of funds supplied by many users. When someone borrows, they borrow from the pool; when someone lends, they add to the pool.

2. Collateralized Borrowing

DeFi loans are usually overcollateralized. This means if you want to borrow $100 worth of crypto, you might need to deposit $150 or more in another asset. This protects lenders in case the borrower’s collateral loses value.

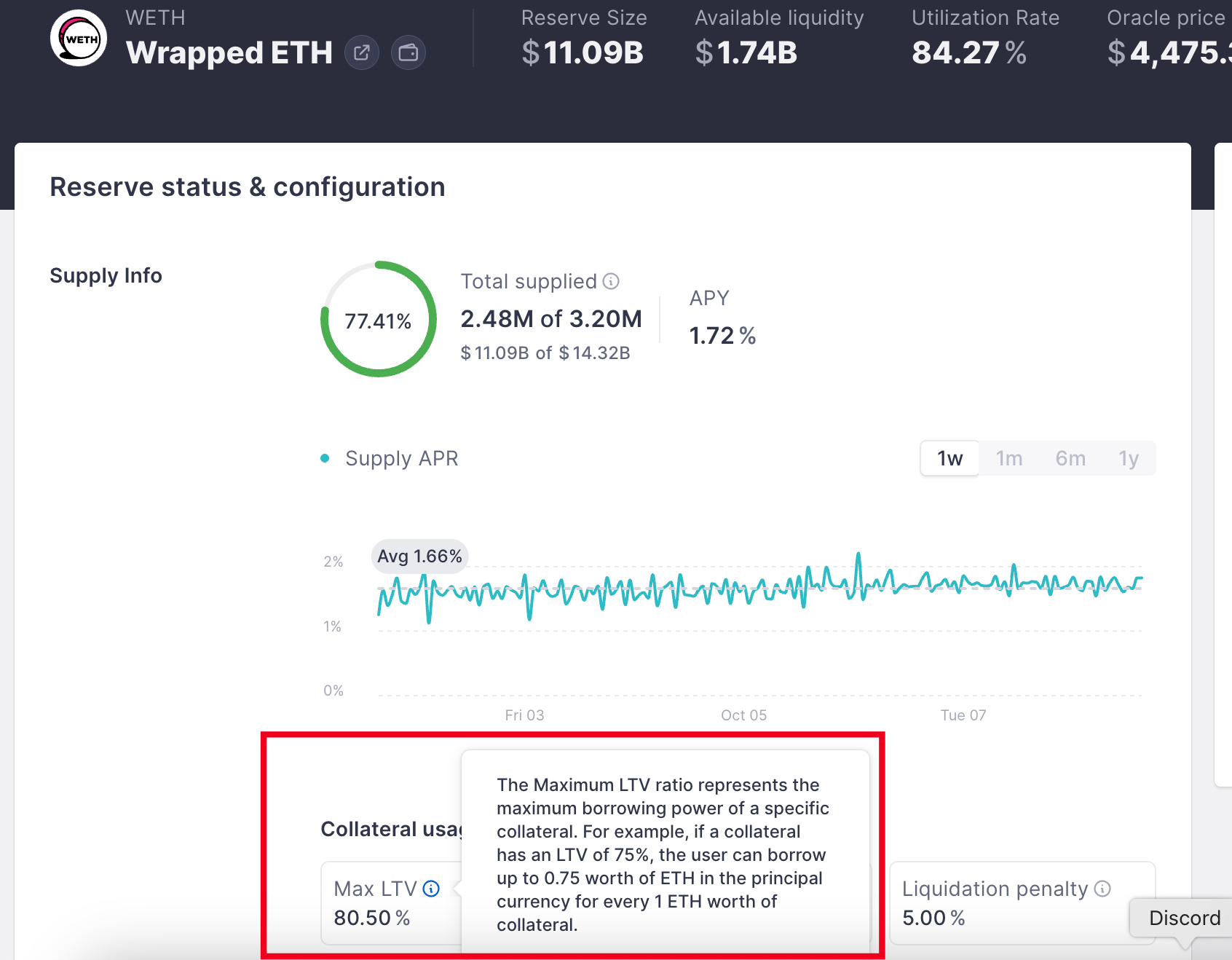

For example, Aave uses the term LTV (loan-to-value).

Let's assume that Ethereum trades at $4000. You deposit 1 Ethereum. Your collateral is now worth $4000.

You now decide to borrow USDC. USDC is pegged 1 to 1 with 1 USD. The maximum amount of USDC you can borrow is: $4000*80.50%=$3220

If Ethereum's price goes up, your collateral is now worth more, so you can borrow more USDC.

If Ethereum's price goes down, you are going to get liquidated. This is represented by the liquidation threshold, which, in this case, is 83%. So, if you borrowed $3220 USDC and Ethereum's price drops below $3879.5 ($3220/83%), you are going to get liquidated.

To avoid getting liquidated, you either need to:

- Add more collateral

- Repay some of your debt

3. Interest Rates

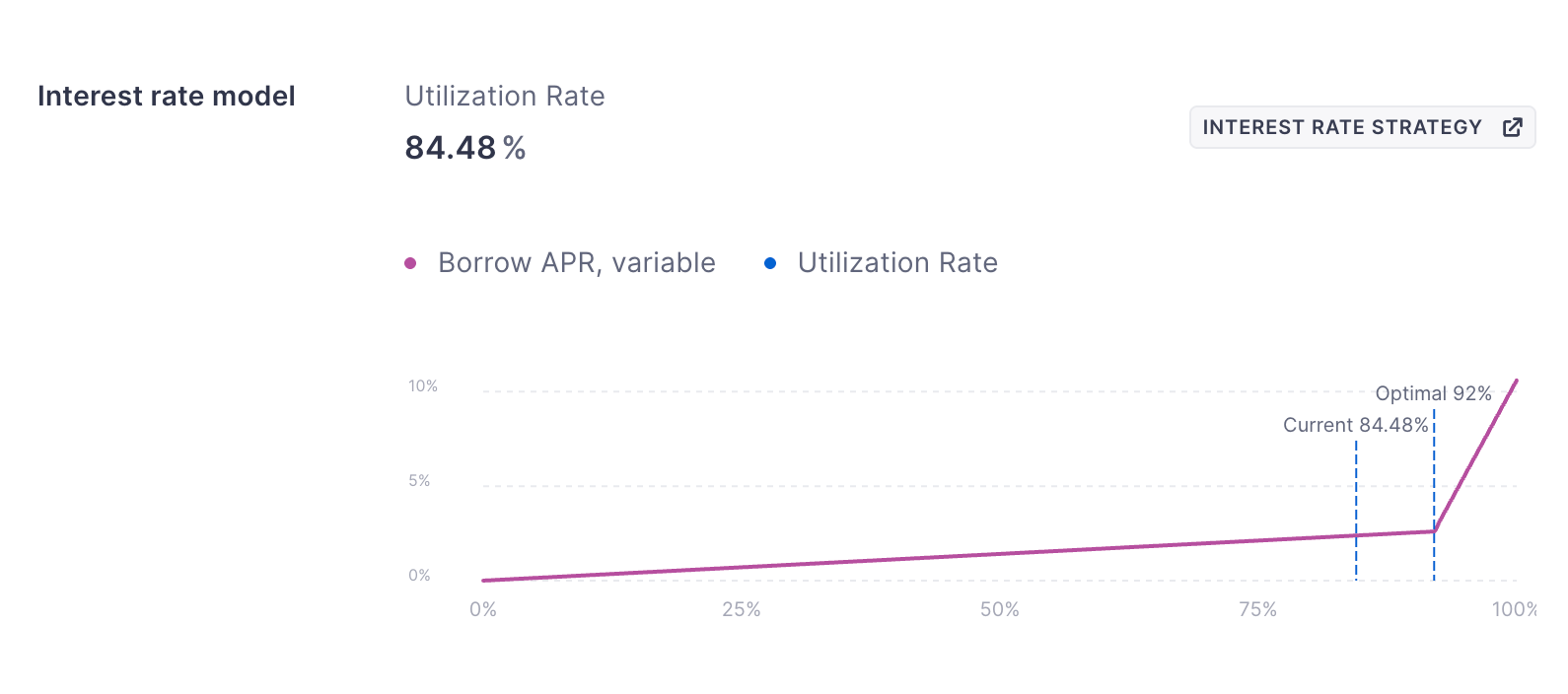

Interest rates are set by mathematical formulas, based on supply and demand:

- If lots of people want to borrow an asset, the interest rate goes up.

- If fewer people want to borrow, the rate goes down.

This dynamic keeps the system balanced. The interest rate formula varies between different pools. As you can see from the screenshot below, for the ETH pool on Aave, once the utilization ratio of Ethereum goes above 92%, the interest rate goes up sharply. This is also called the "kink".

4. Liquidations

If the value of your collateral drops too much and no longer covers your loan, the platform will liquidate (sell off) your collateral to repay the loan. This ensures lenders don’t lose money.

Why Do People Use Lending Platforms?

- Earn Passive Income: Lenders earn interest on assets that would otherwise just sit idle.

- Access Liquidity Without Selling: Borrowers can unlock cash without selling their long-term holdings. For example, you could borrow stablecoins against your ETH without losing exposure to ETH’s potential upside.

- Leverage & Strategies: Advanced users may borrow to trade, hedge, or increase exposure to certain assets.

Examples of DeFi Lending Platforms

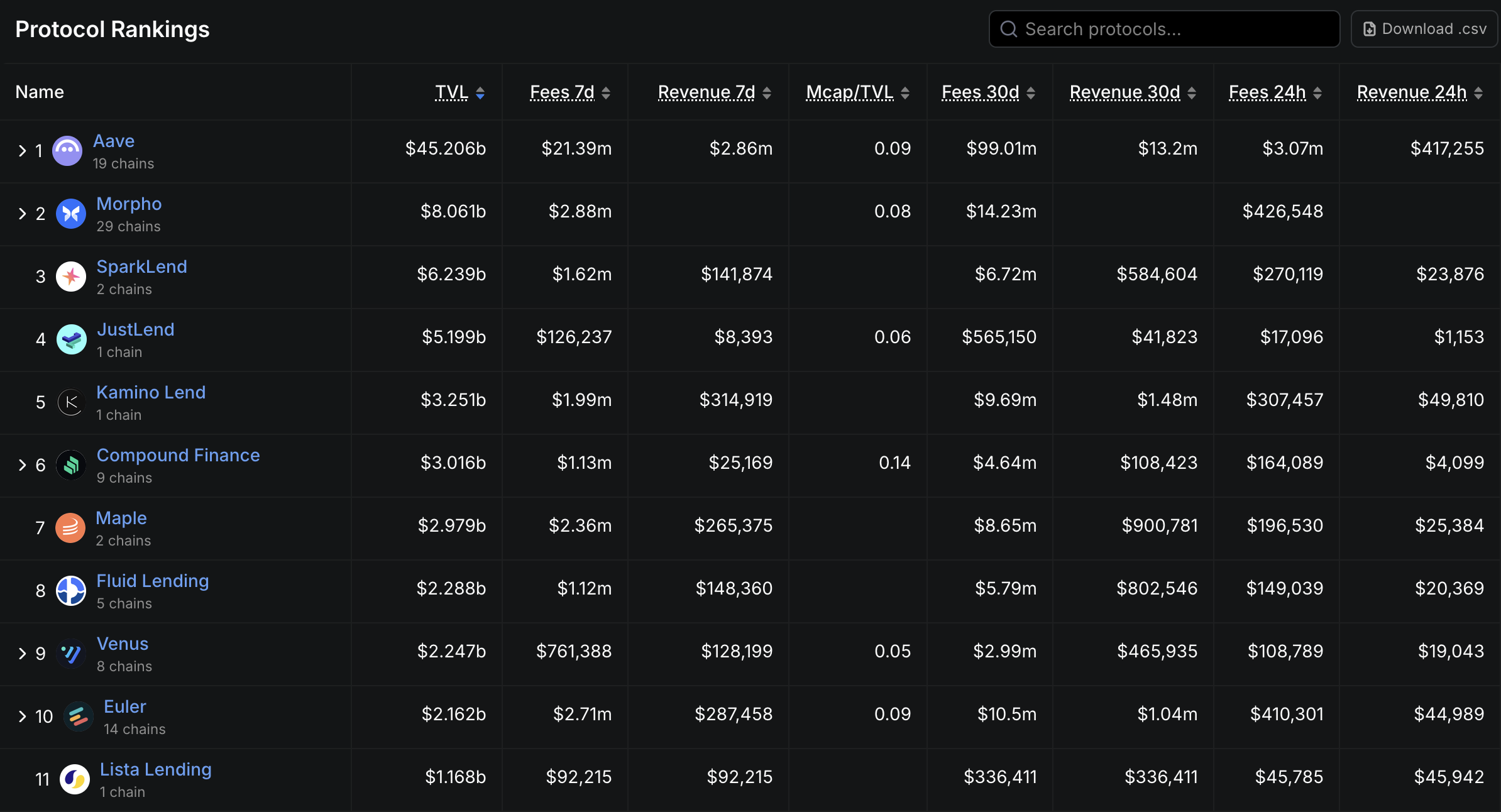

Lending protocols currently are the biggest category in DeFi, according to Defillama.

The most popular, and biggest one by far, is Aave. There are many other lending protocols, as you can see in the screenshot below.

It is worth mentioning Morpho, Euler, and Fluid, which currently are popular options within the EVM (Ethereum Virtaul Machine) ecosystem.

Examples of DeFi Lending Strategies

There are many strategies one can use with lending protocols.

Ultimately, you need to be comfortable with the amount of risks you are taking.

The easiest one is to simply lend funds. Whether these are stablecoins or volatile assets. The APR is often fairly low though.

Users also lend volatile assets (often Bitcoin, Ethereum, or Solana), and borrow stablecoins. With these stablecoins, people either yield farm, or sell them to buy more volatile assets, and redeposit on the lending protocol. This essentially allows you to leverage your positions.

An other extremely popular strategy is to deposit funds on Pendle, and purchase PTs, which are "fixed yield" tokens. You then borrow USDC or USDT, and buy the same PTs again. We call this a loop. It is a very popular strategy. People use either Aave, Morpho or Euler for these. Below you'll see that the PT TVL for Ethena assets on Aave is pretty significant.

Risks to Keep in Mind

While lending platforms can be powerful, they also come with risks:

- Smart Contract Risk: Bugs or exploits in the code could lead to loss of funds. Since people tend to use the same 3-4 lending platforms, this risk is not as present as it used to be. During the 2020-2022 DeFi craze, many new lending markets popped up, and they were often subject to hacks, which resulted in 100% losses for depositors.

- Liquidation Risk: If collateral prices fall quickly, borrowers can lose their deposits. Your private banker won't call you to ask you to add more collateral. If you're sleeping, and the market crashes, you're going to wake up to a sad surprise!

- Market Volatility: High fluctuations can create unstable interest rates or unexpected losses. If the borrow rate spikes for an asset that you borrowed, your cost of debt can drastically go up.

- Platform Risk: Not all platforms are equally secure or decentralized. Stick to the biggest ones. New lending platforms often offer extra token incentives, but they are very often hacked, so be very careful if you see a new money market offering insane incentives.

Final Thoughts

Money markets are one of the cornerstones of DeFi, creating efficient systems for lending and borrowing without banks. For beginners, they offer a simple way to either earn yield on idle crypto or access liquidity without selling. But like all things in crypto, it’s important to start small, learn how the mechanics work, and be mindful of the risks.

As DeFi continues to grow, lending platforms will likely evolve into even more sophisticated financial tools—potentially rivaling traditional banks.

While they're extremely popular, I personally avoid opening positions which might be subject to liquidations due to unfavorable price movements. For example, lending ETH to borrow stablecoins. Simply because I want the peace of mind to know that when I sleep, even if ETH drops by 50%, I can not be liquidated. Obviously, this really depends on your risk aversion, but sleep is more valuable than increasing my expected APR by a few percentage points. Nonetheless, I do often use "loops" on stablecoins (or pegged assets like lending weETH and borrowing ETH) and/or Pendle PT assets.

Comments ()