DeFi 101: Your first steps in DeFi

How to find protocols and where to get the information you need

You're ready to start investing your cryptocurrencies, but you're completely lost. It's understandable, DeFi terms are complicated and most token names are so weird, you don't understand anything...

Well, let me start by saying that it is normal. Trust me, you're not alone, we're all in the same boat here. This industry evolves so quickly, and there are always new projects. You went on Pendle and got a headache trying to understand what it does and what all these tokens are?

You're in the right place.

Chains:

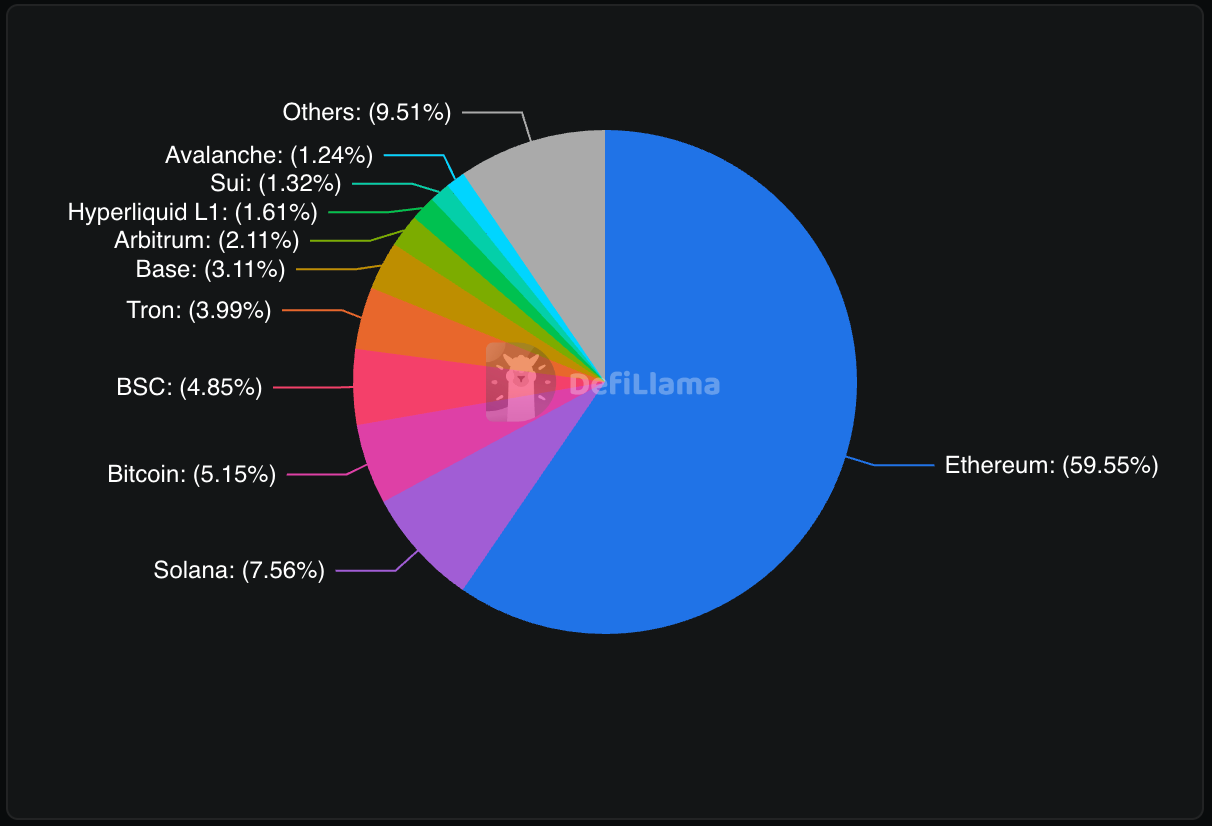

The first concept that you need to understand is that there are many blockchains:

- Ethereum: where DeFi started, largest ecosystem by far.

- L2s (layer two): Arbitrum, Optimism, Base; faster, cheaper, but still tied to Ethereum security.

- Other chains: Solana, Binance Smart Chain (BSC), Avalanche, etc.

No single blockchain can handle everything perfectly. For example, Ethereum is secure but can get slow/expensive. So other chains popped up to offer alternatives.

Don't focus on all chains at the same time, pick one or two.

Every time someone makes a transaction (like sending money, trading tokens, ...), it’s written into the notebook as a new "block" of information. Once written, that block is locked in and linked to all the previous ones — creating a secure chain.

If you want to farm stablecoins, pick Ethereum and a layer 2. If you want to trade shitcoins/memecoins, focus on Solana.

Each chain requires a gas token. Ethereum and L2s use Ethereum to pay for transaction fees. BSC uses BNB, Solana uses Solana, Sonic uses Sonic. Always make sure you understand which gas token you need if you send funds on a new chain. If you send funds to a new chain, but you don't have tokens to pay for the transaction costs, you won't be able to do anything until you have gas tokens!

Finally, each chain has a blockchain explorer! If you click on the blockchain name above, you will find each explorer. They basically track every single transaction happening on the blockchain. If you paste your address there, you can see all your transactions on the selected network.

Protocols:

There's so many protocols, and new ones every day.

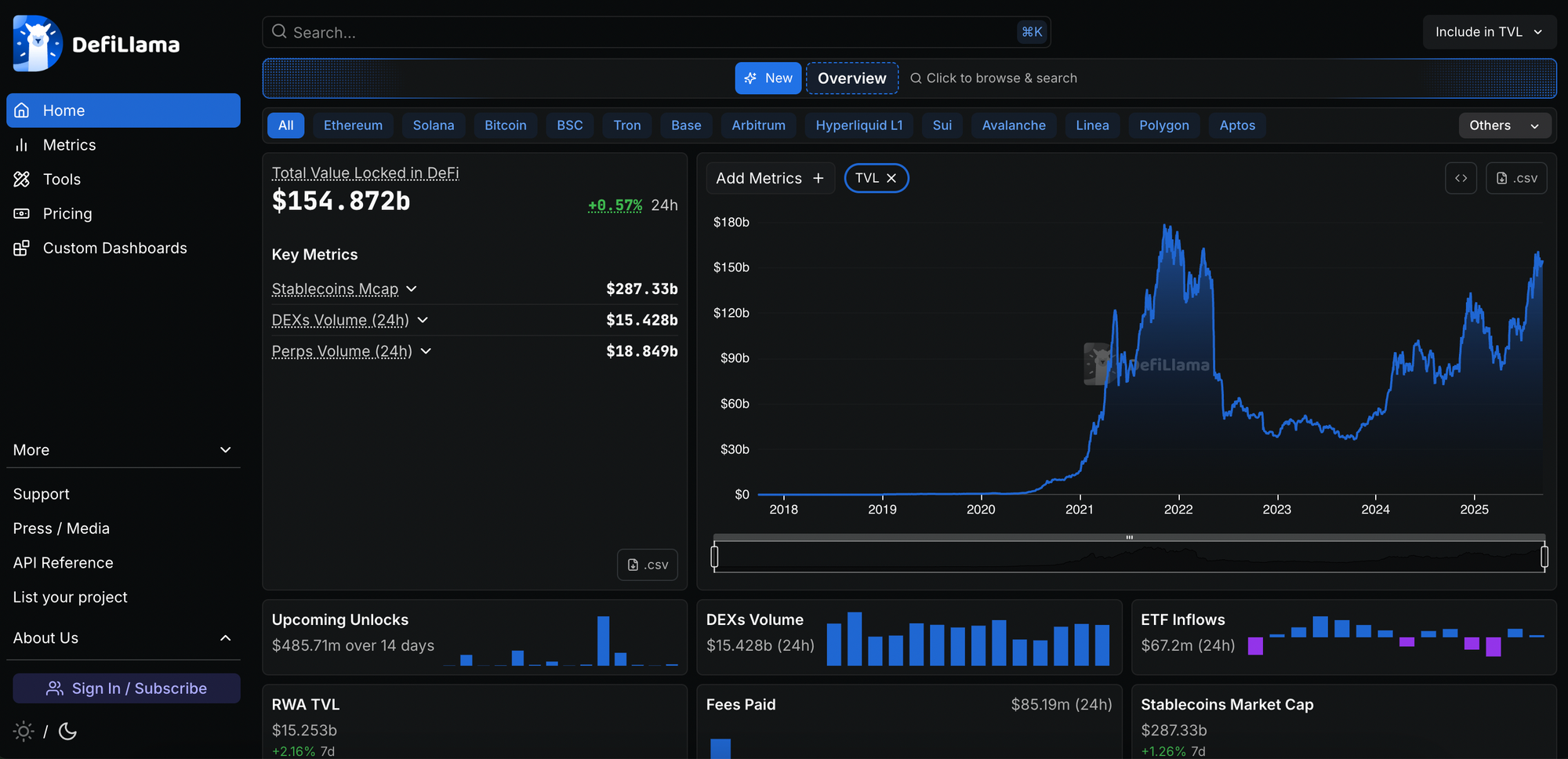

I could recommend many websites in this section, but you only need one: Defillama!

Spend some time on Defillama, look into the metrics tab.

For example, the yields tab can give you yield farming ideas.

The airdrops tab lists tokenless protocols that may airdrop tokens.

Use the search function on Defillama, and click on the "website" icon under "Protocol Information".

Other sources?

Twitter/X is the best place to learn more about what's happening in DeFi. Every protocol has an account and announces updates there. There are also many good accounts to follow, but it always depends on your niche.

For everyone, I would recommend:

- The Daily Degen on Substack. You'll find everything you need here. Twitter link here and it's made by Rektdiomedes.

- Linn's leverage on Substack. Again, everything you need, with a bit more DeFi stuff, made by Crypto Linn.

Most protocols also have a Discord and/or Telegram, so you should join them and see what people are talking about. It's also good to see what the sentiment is on socials.

Final Thoughts

"If you don't know where the yield is coming from, you are the yield!"

A famous saying in DeFi. Make sure that you understand where the yield comes from. You can find answers on discord, twitter threads (use the search function), the protocol's docs. If you still didn't find your answer, maybe it's better to stay away.

Also, start experimenting with pocket money. If you start a sport or a hobby, you'll probably need to spend cash on lessons or equipment. Experimenting with $10-100 is, in comparison, quite cheap. Deposit stablecoins on Aave for a few weeks just to see your own digital crytpo bank.

Check the next part in this guide: What is staking?

Comments ()